Day trading is fast, demanding, and unforgiving of mistakes. Prices move quickly, emotions rise just as fast, and decisions must be made with clarity. That’s why etherions .com is often referenced by traders looking for structured thinking in high-speed markets.

Unlike long-term investing, day trading focuses on short timeframes, tight risk control, and consistent execution. Success depends less on prediction and more on preparation.

Understanding how disciplined day trading works helps traders avoid impulsive decisions and approach markets with confidence.

Understanding Etherions .com Day Trading Approach

Etherions .com day trading emphasizes process over excitement. Trades are planned before execution, with clear entry, exit, and risk levels.

Rather than chasing every price move, the focus stays on repeatable setups that align with market conditions.

This structured approach helps traders remain consistent even during volatile sessions.

Why Day Trading Attracts Active Traders

Day trading appeals to those who prefer frequent opportunities and quick feedback. Markets like crypto operate 24/7, offering constant movement.

Etherions .com discussions often highlight that opportunity comes with responsibility. More trades mean greater exposure to risk.

Understanding this balance is critical before committing to an intraday strategy.

Timeframes Used in Day Trading

Day traders rely on short timeframes such as 1-minute, 5-minute, and 15-minute charts. These reveal immediate price behavior and momentum.

Etherions .com day trading analysis often combines multiple timeframes to avoid tunnel vision.

Higher timeframes provide trend context, while lower ones refine entries.

Technical Analysis for Intraday Trades

Technical analysis drives most day trading decisions. Price action, support and resistance, and volume patterns guide entries and exits.

Indicators like moving averages and VWAP help traders assess momentum.

Etherions .com emphasizes clarity—too many indicators often reduce decision quality.

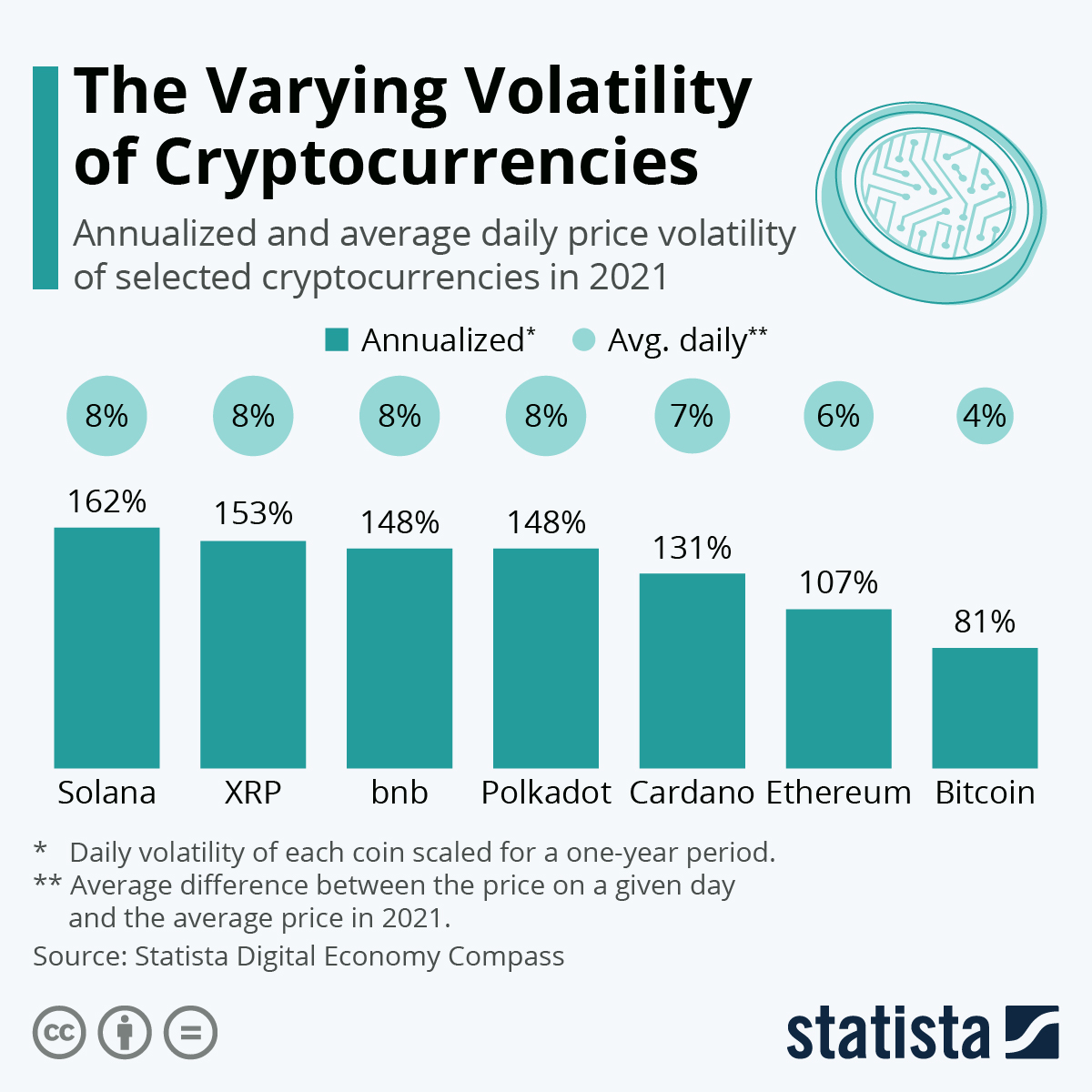

Volatility as Opportunity and Risk

Volatility creates opportunity but increases risk. Rapid price swings can amplify gains and losses within minutes.

Etherions .com day trading strategies treat volatility with respect, not excitement.

Risk limits are adjusted based on market conditions to avoid overexposure.

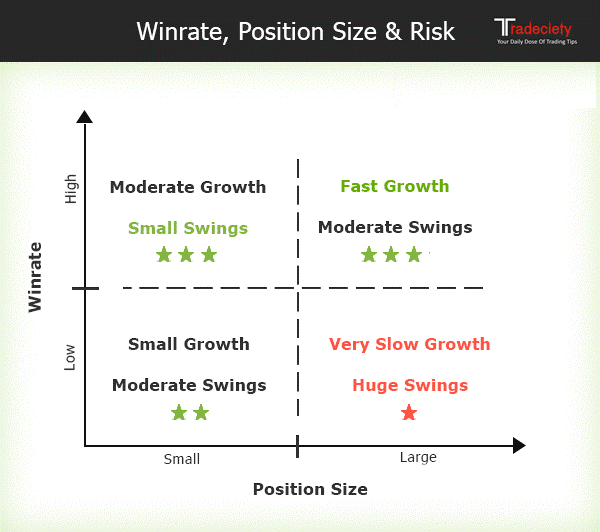

Risk Management in Day Trading

Risk management is the foundation of day trading survival. Stop-loss orders, position sizing, and daily loss limits protect capital.

Etherions .com day trading analysis stresses that no single trade should significantly impact the account.

Consistency matters more than individual wins.

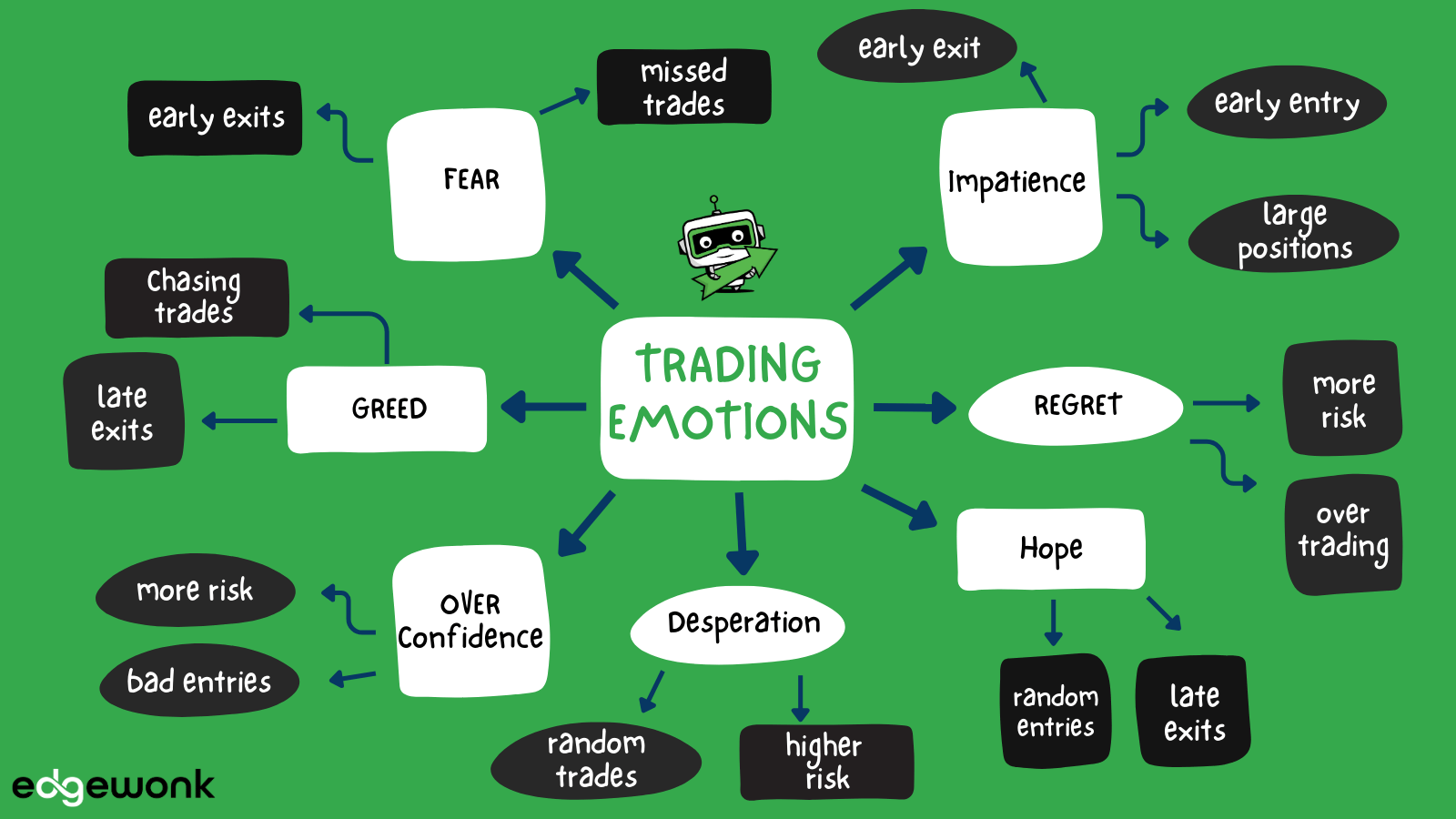

Trading Psychology During Fast Markets

Emotions intensify in fast markets. Fear leads to premature exits, while greed causes overtrading.

Etherions .com highlights emotional control as a skill developed through structure and repetition.

Clear rules reduce emotional interference during decision-making.

Market Sessions and Timing

Not all hours offer equal opportunity. Liquidity and volatility vary across global trading sessions.

Etherions .com day trading insights often focus on high-activity periods when price movement is more predictable.

Choosing the right session improves efficiency and focus.

Common Day Trading Mistakes

Overtrading, revenge trading, and ignoring stop losses are frequent causes of failure.

Etherions .com day trading analysis emphasizes discipline over frequency.

Avoiding mistakes often matters more than finding new strategies.

Adapting Strategies to Market Conditions

Markets evolve throughout the day. Trending sessions require different tactics than ranging ones.

Etherions .com encourages flexibility without abandoning structure.

Adaptation improves consistency across varying conditions.

FAQ

What is etherions .com day trading?

It refers to a structured, disciplined approach to intraday trading in crypto markets.

Is day trading suitable for beginners?

It can be, but beginners should start small and focus on risk control.

How important is risk management in day trading?

It is essential and determines long-term survival.

Do day traders need constant screen time?

Yes, active monitoring is usually required during trading sessions.

Can volatility improve day trading results?

Volatility creates opportunity, but only with strict discipline.

Conclusion

Day trading demands focus, preparation, and emotional control. Etherions .com day trading insights emphasize structure over excitement and risk control over prediction.

By understanding timeframes, volatility, and psychology, traders gain clarity in fast-moving markets.

Success in day trading comes not from chasing every move, but from executing a well-defined process consistently.