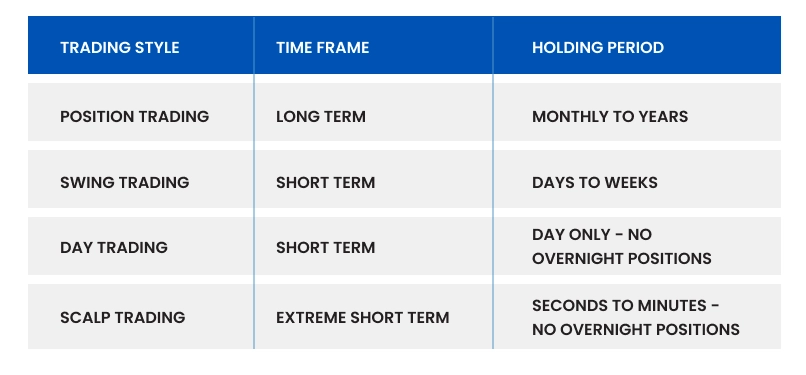

Swing trading sits between fast-paced day trading and long-term investing, offering a balance of flexibility and structure. That’s why ftasiastock is often mentioned by traders interested in capturing multi-day price movements without constant screen time.

Instead of reacting to every market fluctuation, swing trading focuses on identifying trends, pullbacks, and momentum shifts. This approach allows traders to plan trades calmly and manage risk more effectively.

Understanding how swing trading works helps traders avoid emotional decisions and build consistency over time.

Understanding FTAsiaStock Swing Trading Approach

FTAsiaStock swing trading emphasizes patience and preparation. Trades are selected based on clear technical conditions rather than short-term noise.

Setups often target price movements that unfold over several days or weeks. This timeframe reduces pressure and allows analysis to guide decisions.

The approach favors quality over quantity, helping traders avoid overtrading.

Why Swing Trading Appeals to Many Traders

Swing trading attracts traders who want opportunity without constant monitoring. Markets don’t need to be watched minute by minute.

FTAsiaStock discussions highlight how swing trading fits around work and personal schedules while still offering meaningful market exposure.

This balance makes swing trading accessible to a wide range of traders.

Identifying Trends for Swing Trades

Trend identification is central to swing trading success. Traders look for higher highs in uptrends and lower lows in downtrends.

FTAsiaStock swing trading analysis focuses on aligning trades with dominant market direction.

Trading with the trend improves probability and reduces unnecessary risk.

Using Technical Indicators in Swing Trading

Indicators help confirm trends and timing. Moving averages, RSI, and MACD are commonly used to assess momentum and potential reversals.

FTAsiaStock emphasizes simplicity—indicators support decisions but don’t replace price action.

Clear signals reduce hesitation and confusion.

Entry and Exit Planning for Swing Trades

Successful swing trading requires clear entry and exit rules. Traders define targets and stop levels before entering positions.

FTAsiaStock swing trading strategies stress planning over impulse.

Predefined exits protect profits and limit losses when markets move unexpectedly.

Risk Management in Swing Trading

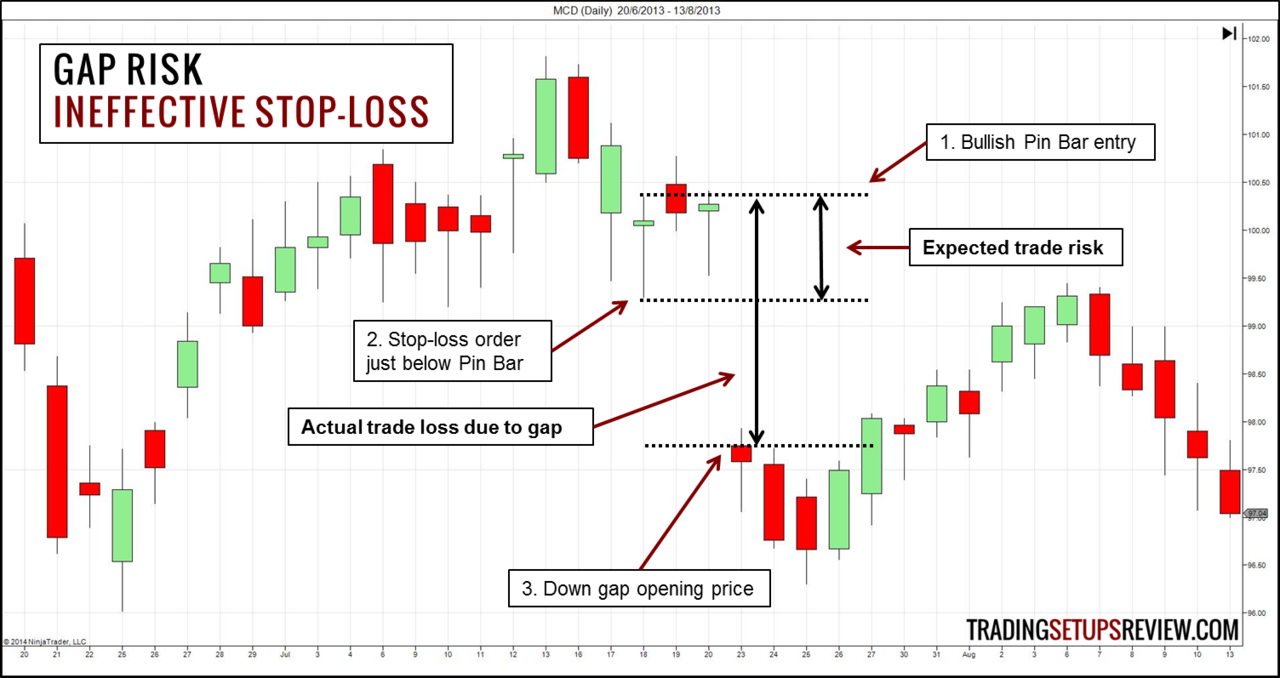

Risk management determines long-term success. Position sizing and stop-loss placement control downside exposure.

FTAsiaStock swing trading highlights risking only a small portion of capital per trade.

Consistent risk control keeps traders in the game during losing streaks.

Holding Periods and Trade Patience

Swing trades require patience. Prices may fluctuate before reaching targets.

FTAsiaStock encourages trusting the plan rather than reacting to short-term pullbacks.

Patience often separates successful swing traders from frustrated ones.

Market Conditions That Favor Swing Trading

Swing trading performs best in trending or moderately volatile markets. Flat, choppy conditions reduce effectiveness.

FTAsiaStock analysis includes assessing market environment before placing trades.

Choosing the right conditions improves consistency.

Psychology and Emotional Control

Emotions still affect swing traders, especially during overnight holds. Fear and impatience can disrupt plans.

FTAsiaStock emphasizes discipline and emotional awareness.

Clear rules help traders stay objective.

Common Swing Trading Mistakes

Common mistakes include entering trades late, moving stop losses, and ignoring broader trends.

FTAsiaStock swing trading analysis focuses on avoiding preventable errors.

Consistency improves when mistakes are minimized.

FAQ

What is FTAsiaStock swing trading?

It refers to a structured approach to swing trading focused on trends, planning, and risk management.

Is swing trading suitable for beginners?

Yes, it offers more time for analysis compared to day trading.

How long are swing trades held?

Typically from a few days to several weeks.

Does swing trading require constant monitoring?

No, it requires periodic review rather than constant screen time.

Is risk management important in swing trading?

Yes, it is essential for long-term success.

Conclusion

Swing trading offers a balanced way to participate in markets without constant pressure. FTAsiaStock swing trading insights highlight the value of patience, planning, and disciplined execution.

By focusing on trends, technical confirmation, and risk control, traders improve consistency and confidence.

Rather than reacting to every move, swing trading rewards those who follow a clear, repeatable process.