When Bitcoin suddenly drops, confusion spreads fast. Investors search for explanations, headlines multiply, and emotions take over rational thinking. That’s where lapzoo com often comes into the picture, helping readers make sense of why the bitcoin price is down without exaggeration or panic.

Bitcoin price movements rarely happen for a single reason. They are usually the result of market psychology, macroeconomic pressure, technical levels, and broader cryptocurrency sentiment.

Understanding these factors matters because reacting emotionally to price drops often leads to poor decisions. A clearer view helps investors respond thoughtfully rather than impulsively.

Why Bitcoin Price Drops Trigger Strong Reactions

Bitcoin is not just another asset; it represents the entire cryptocurrency market for many people. When its price falls, confidence across the market weakens.

Unlike traditional markets, crypto trades nonstop, which accelerates emotional reactions. Fear spreads quickly through social media and trading platforms.

Lapzoo com discussions often emphasize that sharp reactions say more about sentiment than fundamentals.

Market Sentiment and Fear Cycles

Bitcoin price declines are frequently driven by sentiment shifts. When fear dominates, selling pressure increases regardless of long-term value.

Indicators like the Fear and Greed Index show how emotions influence market behavior. Extreme fear often coincides with heavy selling.

Lapzoo com analysis highlights how sentiment cycles repeat across bull and bear phases.

Macroeconomic Pressure on Bitcoin

Global economic conditions play a major role in why bitcoin price is down. Interest rate hikes, inflation concerns, and stronger fiat currencies reduce appetite for risk assets.

When investors move toward safer assets, speculative markets like crypto feel the impact first.

Lapzoo com perspectives often connect bitcoin movements to broader financial conditions rather than isolated crypto events.

Influence of Traditional Financial Markets

Bitcoin has shown increasing correlation with stock markets, especially during uncertain economic periods.

When equities decline, crypto often follows as investors reduce overall exposure. This challenges the idea of Bitcoin as a fully independent hedge.

Lapzoo com analysis points out that short-term correlations don’t negate long-term decentralization narratives.

Whale Activity and Large Sell-Offs

Large holders, often called whales, can significantly impact bitcoin price through large trades.

When whales sell, it can trigger stop-loss orders and liquidations, accelerating downward movement.

Lapzoo com commentary stresses that whale activity amplifies volatility but doesn’t always reflect long-term sentiment.

Leverage and Liquidations in Crypto Markets

Leverage plays a major role in sharp bitcoin price drops. When prices fall, leveraged positions are forced to close.

This creates a cascade effect where liquidations push prices lower in a short time.

Lapzoo com highlights how excessive leverage often turns minor pullbacks into dramatic declines.

Regulatory News and Uncertainty

Regulatory headlines can quickly affect market confidence. Even rumors or proposed regulations may trigger selling.

Governments discussing stricter oversight often lead to short-term fear, even if long-term impact is unclear.

Lapzoo com encourages separating confirmed policy actions from speculative news.

Technical Analysis and Key Price Levels

Technical levels matter in crypto trading. When bitcoin breaks key support zones, automated selling often follows.

Traders watch moving averages, trendlines, and historical price zones closely.

Lapzoo com analysis explains that technical breakdowns often accelerate existing trends rather than create them.

Media Influence and Narrative Shifts

Media coverage plays a powerful role in shaping perception. Negative headlines amplify fear during downturns.

Sensational language can distort reality, making normal corrections seem catastrophic.

Lapzoo com focuses on context rather than headlines when assessing price movements.

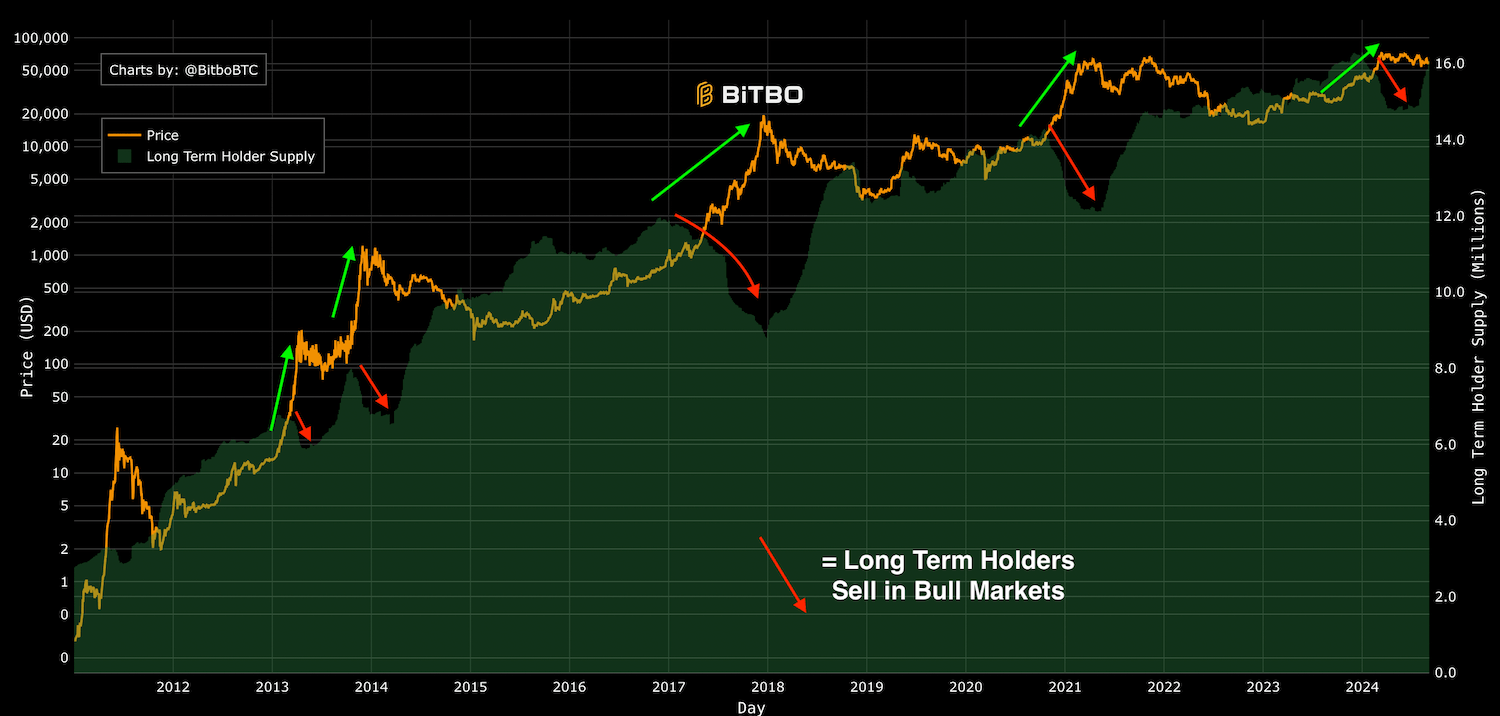

Long-Term Holders vs Short-Term Traders

Bitcoin markets are divided between long-term holders and short-term traders.

Price drops often affect traders more severely, while long-term holders remain relatively calm.

Lapzoo com emphasizes understanding which group is driving current price action.

What History Says About Bitcoin Price Drops

Bitcoin has experienced multiple major corrections throughout its history. Many felt devastating at the time.

Despite repeated crashes, bitcoin has historically recovered and reached new highs over longer periods.

Lapzoo com uses historical context to reduce panic-driven decision-making.

Common Mistakes Investors Make During Price Drops

Panic selling, over-leveraging, and chasing news are common mistakes during downturns.

Emotional decisions often lock in losses instead of managing risk.

Lapzoo com advises focusing on strategy rather than short-term noise.

FAQ

Why is bitcoin price down today?

Bitcoin price drops are usually caused by a mix of market sentiment, macroeconomic factors, and trading behavior.

Does a bitcoin price drop mean the market is over?

No, corrections are common in bitcoin’s history and don’t automatically signal long-term failure.

Should investors panic when bitcoin falls?

Panic often leads to poor decisions. Understanding the reasons behind the move is more productive.

Is regulation the main reason bitcoin drops?

Regulation can influence price, but it’s rarely the sole cause.

Has bitcoin recovered from drops before?

Yes, bitcoin has recovered from multiple major declines over time.

Conclusion

Bitcoin price drops can feel alarming, especially in fast-moving crypto markets. Lapzoo com perspectives help place these movements into context rather than reacting emotionally.

By understanding sentiment, macro factors, leverage, and historical patterns, investors gain clarity during uncertain periods.

Instead of focusing solely on short-term price action, informed analysis allows for calmer, more strategic decision-making in the ever-volatile cryptocurrency market.