Forex markets move around the clock, reacting instantly to global events, economic data, and trader sentiment. That constant motion is why sevenseventech forex trading analysis attracts attention from traders seeking structured insight rather than emotional reactions.

Successful trading is rarely about predicting every move. It’s about understanding probabilities, managing risk, and responding to market conditions with discipline.

This article explores how forex trading analysis is approached through a methodical lens, focusing on clarity, structure, and long-term consistency.

Understanding SevenSevenTech Forex Trading Analysis

SevenSevenTech forex trading analysis emphasizes structure over speculation. Market behavior is studied using data, price action, and repeatable methods.

Rather than chasing every opportunity, analysis focuses on high-probability setups supported by technical and contextual confirmation.

This approach reduces overtrading and improves decision quality.

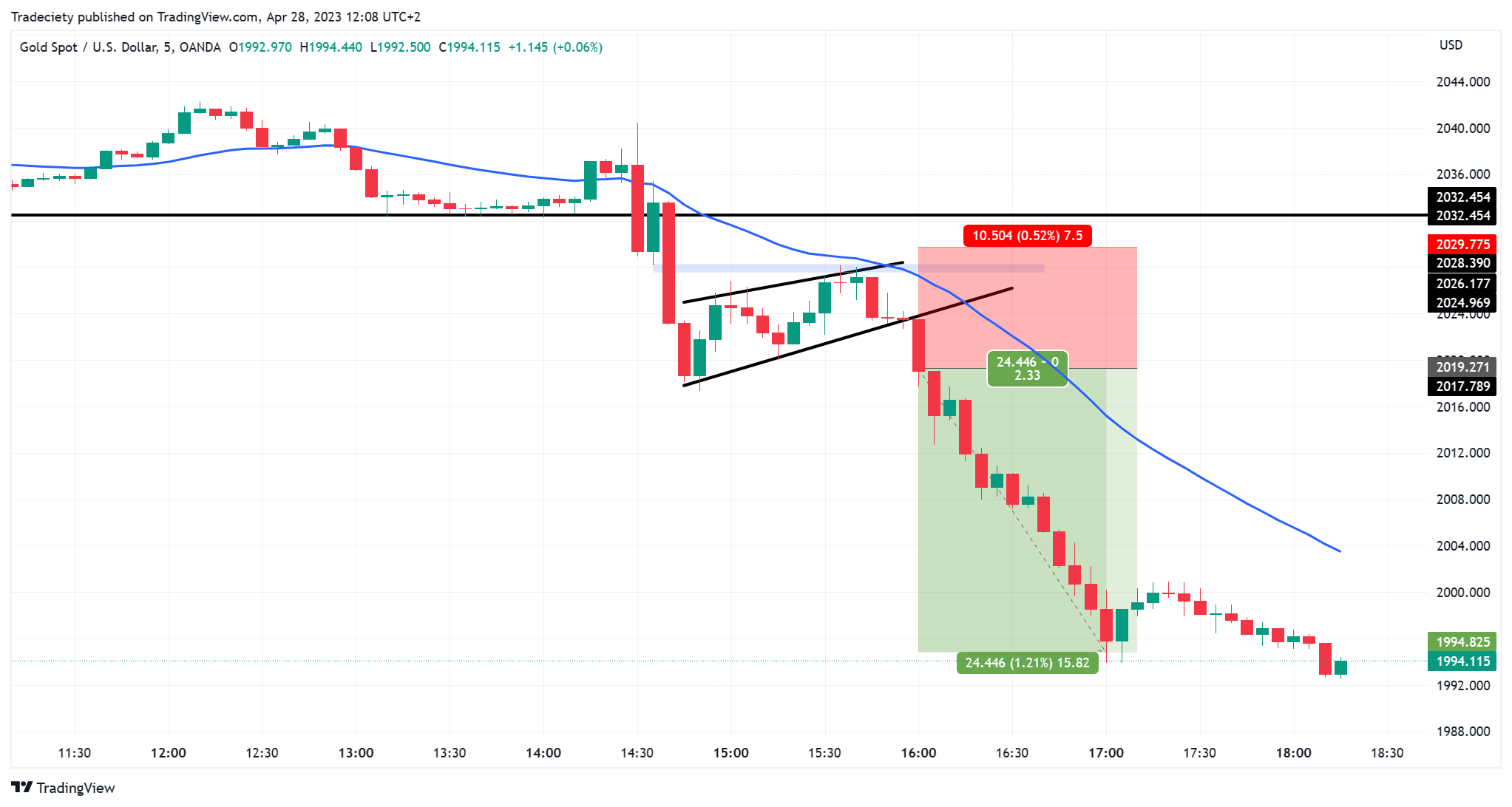

Role of Technical Analysis in Forex Trading

Technical analysis forms the backbone of most forex strategies. Price charts reveal trends, support levels, and momentum shifts.

Indicators such as moving averages, RSI, and MACD help traders interpret market strength and timing.

SevenSevenTech-style analysis uses indicators as guidance, not absolute signals.

Market Structure and Trend Identification

Understanding market structure helps traders align with dominant trends. Higher highs and higher lows signal uptrends, while lower lows indicate downtrends.

SevenSevenTech forex trading analysis prioritizes trading with the trend rather than against it.

Trend alignment increases the probability of successful trades.

Importance of Economic Data in Forex Markets

Forex markets react strongly to economic releases such as interest rate decisions, employment data, and inflation reports.

Analysis incorporates these events to anticipate volatility rather than being surprised by it.

SevenSevenTech perspectives treat economic news as context, not trading signals alone.

Risk Management as a Core Principle

Risk management determines long-term survival in forex trading. Position sizing, stop-loss placement, and risk-reward ratios protect capital.

SevenSevenTech forex trading analysis emphasizes preserving capital over maximizing gains.

Consistent risk control allows traders to stay in the market through losing periods.

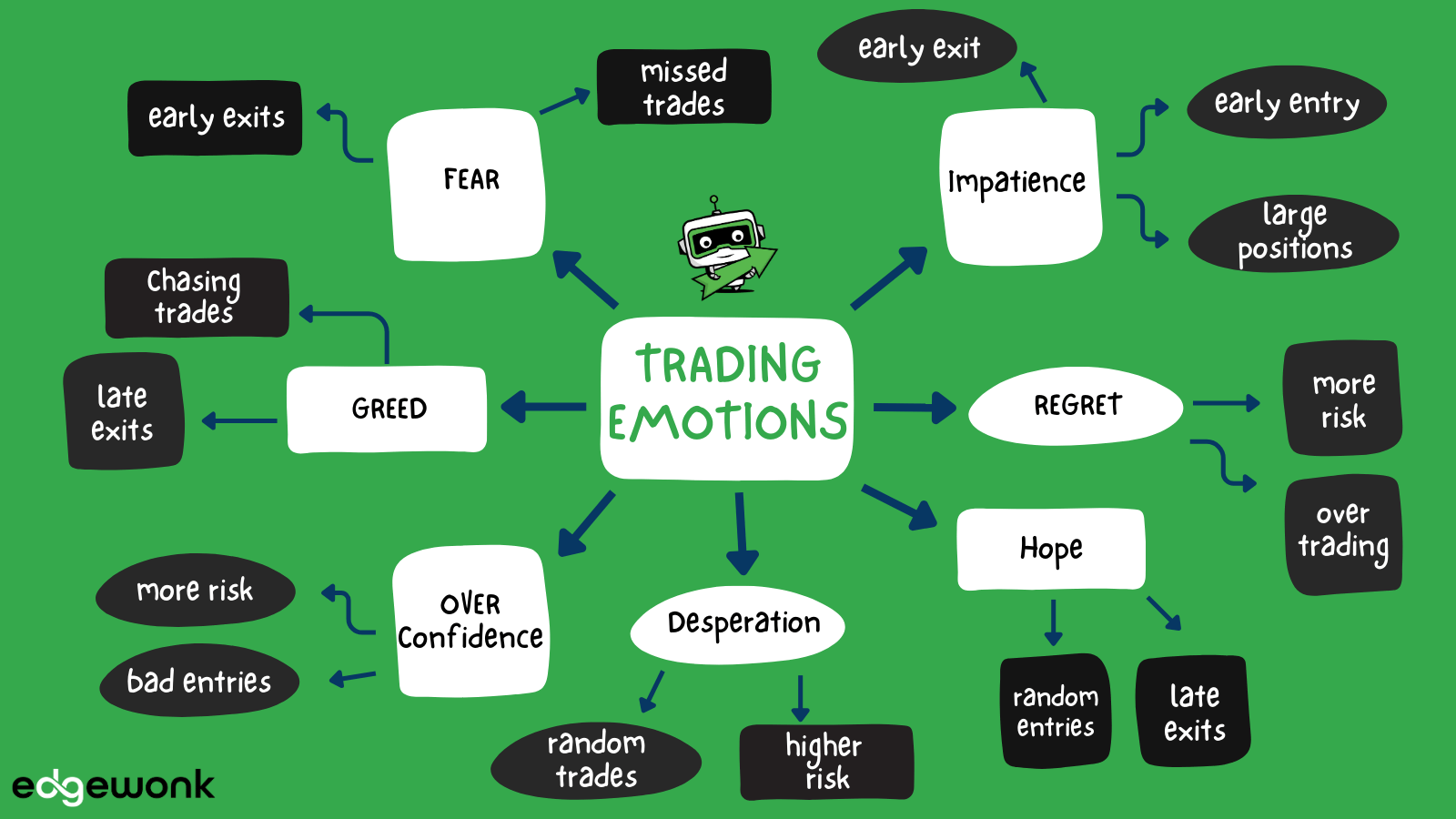

Trading Psychology and Emotional Control

Emotions often cause more losses than poor analysis. Fear and greed distort judgment, especially during volatile markets.

SevenSevenTech-style analysis highlights discipline and patience as skills developed over time.

Clear rules reduce emotional decision-making.

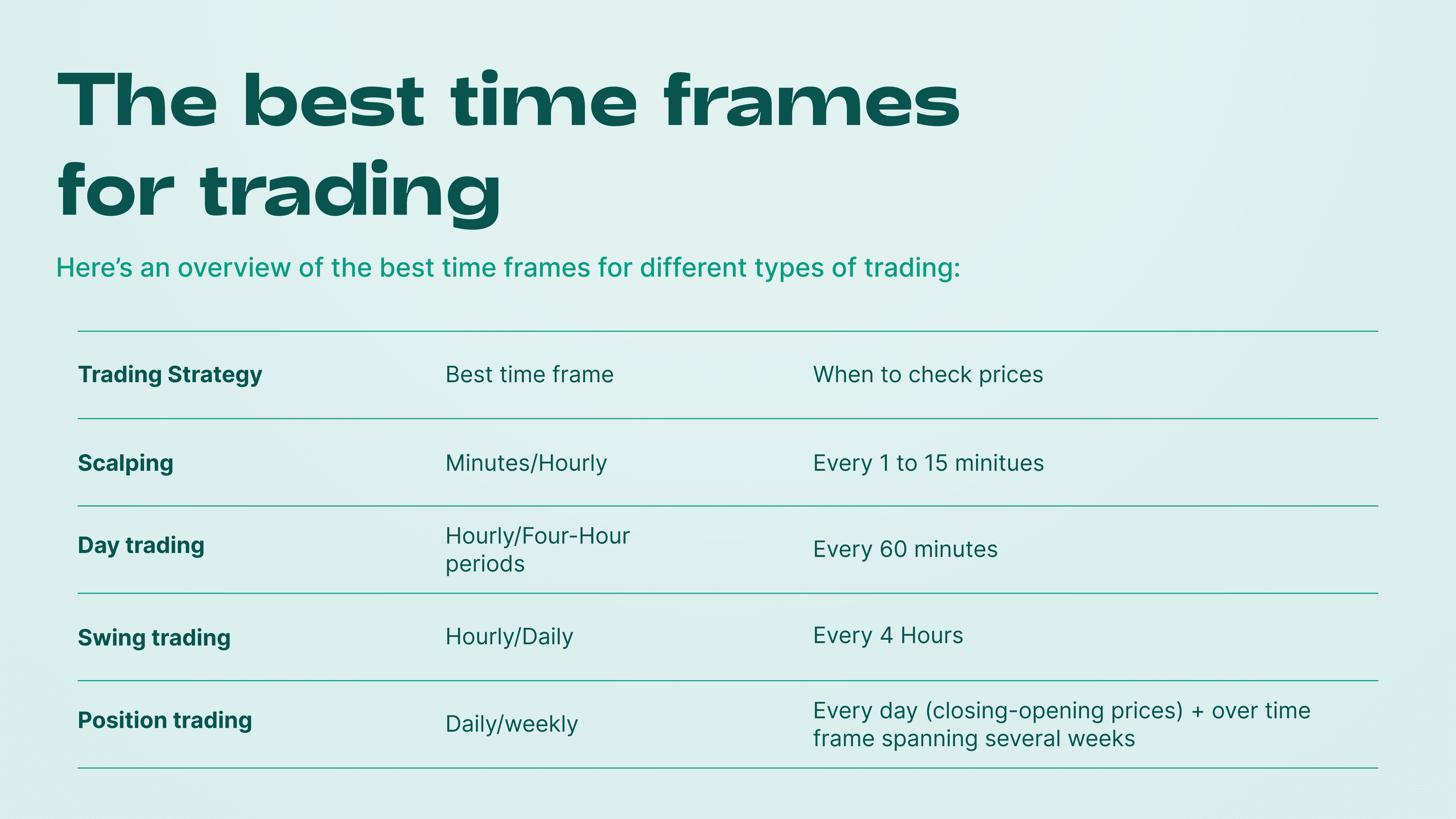

Timeframes and Multi-Timeframe Analysis

Analyzing multiple timeframes provides broader context. Higher timeframes define trend direction, while lower timeframes refine entries.

SevenSevenTech forex trading analysis uses this layered approach to improve timing and reduce false signals.

This creates alignment between short-term and long-term perspectives.

Common Mistakes in Forex Trading Analysis

Overloading charts with indicators, ignoring risk, and trading without a plan are frequent mistakes.

SevenSevenTech analysis encourages simplicity and clarity over complexity.

Avoiding common errors often improves performance more than adding new tools.

Adapting to Changing Market Conditions

Forex markets evolve with global events and economic cycles. Strategies must adapt without losing structure.

SevenSevenTech forex trading analysis supports flexibility within defined rules.

Adaptation ensures strategies remain relevant over time.

FAQ

What is sevenseventech forex trading analysis?

It refers to a structured, disciplined approach to analyzing forex markets using technical, economic, and risk-based principles.

Does this approach rely on predictions?

No, it focuses on probability and risk management rather than exact predictions.

Is this suitable for beginner traders?

Yes, because it emphasizes discipline and capital protection.

How important is risk management in forex?

It is essential. Without it, even good analysis fails.

Can market conditions change analysis results?

Yes, which is why adaptability is part of the strategy.

Conclusion

Forex trading rewards discipline more than speed. SevenSevenTech forex trading analysis highlights the importance of structure, risk control, and emotional stability.

By focusing on trends, technical tools, and economic context, traders gain clarity in complex markets.

Rather than chasing every move, consistent analysis builds a foundation for long-term trading success.